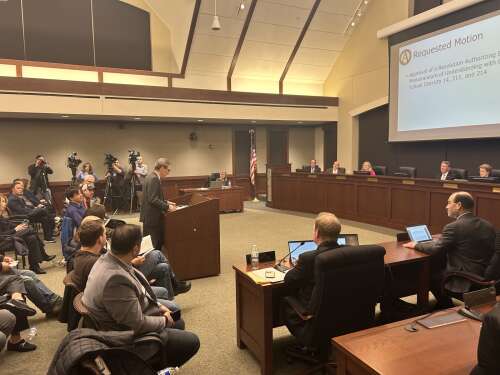

The Arlington Heights village board on Monday approved a deal nearly two years in the making that aims to resolve the property tax dispute between the Chicago Bears and three area school districts.

The 8-0 vote of the mayor and trustees is the first step in the approval process for the 12-page memorandum of understanding, which would lower the Bears’ tax bill at the 326-acre Arlington Park property at least through 2027.

The Palatine Township Elementary District 15 school board will consider the agreement Wednesday night, and the boards for Northwest Suburban High School District 214 and Palatine-Schaumburg High School District 211 will take votes Thursday night.

Mayor Tom Hayes called the pact a significant and necessary step that gets “us further down the road than we’ve ever been before in determining if a Chicago Bears stadium and associated development” could be built at the shuttered racetrack site.

Besides resolving tax issues, Hayes noted the memorandum allows village officials to receive more definite plans and information that will allow them to study the Bears’ plans for a $5 billion mixed-use, transit-oriented development.

The Bears told their consultants to pause economic, traffic and other studies related to the Arlington Park proposal when the tax dispute arose with the schools in the spring of 2023. But the team is now required to resume that work in early 2025, under the agreement.

“We’ve been very clear that we cannot review this project in any way, shape or form without having that type of information,” said Village Manager Randy Recklaus, who added there is also nothing preventing the team from continuing its due diligence at other potential stadium sites.

The Bears unveiled plans for a mixed-use district at Arlington Park in late 2022, but shelved those plans amid a tax dispute with area school districts and shift in focus to an envisioned new Chicago lakefront stadium.

Courtesy of Chicago Bears

Paul Shadle, an attorney representing the Bears who helped craft the memorandum, thanked village and school officials Monday night for developing a “very complicated, but good agreement.”

The Bears haven’t formally signed the document, but what led to the series of board votes this week “is them telling us they could agree to this agreement as written,” Recklaus said.

The team purchased the racetrack for $197.2 million in February 2023, though under President and CEO Kevin Warren, Bears brass have spent recent months touting plans for a new publicly-owned stadium on the Chicago lakefront.

Under the memorandum with the schools and village, the Bears would pay an annual $3.6 million property tax bill from 2024 through 2027 — which is less than the $8.9 million the organization is expected to pay for the 2023 tax year.

The lower tax bill could remain the same from 2028 through 2030 if — by Dec. 31, 2027 — the team submits formal plans seeking village zoning approvals for a new stadium.

The bill would stay the same from 2031 until construction begins if — by Dec. 31, 2030 at the latest — the team applies for building permits to begin construction.

But if the Bears don’t meet any of those milestones, annual payments would be tied to increases in the Consumer Price Index between 2% and 5%.

The sprawling Arlington Park property on the west side of Arlington Heights — now vacant and owned by the Chicago Bears — has been the subject of a tax dispute since early 2023.

Joe Lewnard/[email protected], February 2024

The tax bill is based off a property value of $124.7 million — the number that was set by the Cook County Board of Review last February. But instead of being assessed at 25% of the fair market value — the common commercial standard in Cook County — the site would be considered “unimproved” real estate now that all buildings have been demolished, and given a 10% assessment level, according to the agreement.

Critics of the deal spoke before the board voted Monday night, including Martin Bauer, who is running for village trustee in April’s election. He called for a special referendum for voters to decide if the Bears redevelopment should happen.

Martin Bauer, a candidate for Arlington Heights village board, spoke in opposition to the Bears memorandum of understanding during Monday night’s board meeting.

Christopher Placek/[email protected]

The memorandum “certainly gives the Bears the tax certainty — that is, the tax break — that they’ve been asking for, and that’s great,” Bauer said. “I honestly don’t think that Arlington Heights and the school districts are getting a whole lot in return.”